Heartwarming Info About How To Avoid Paying Tax In Uk

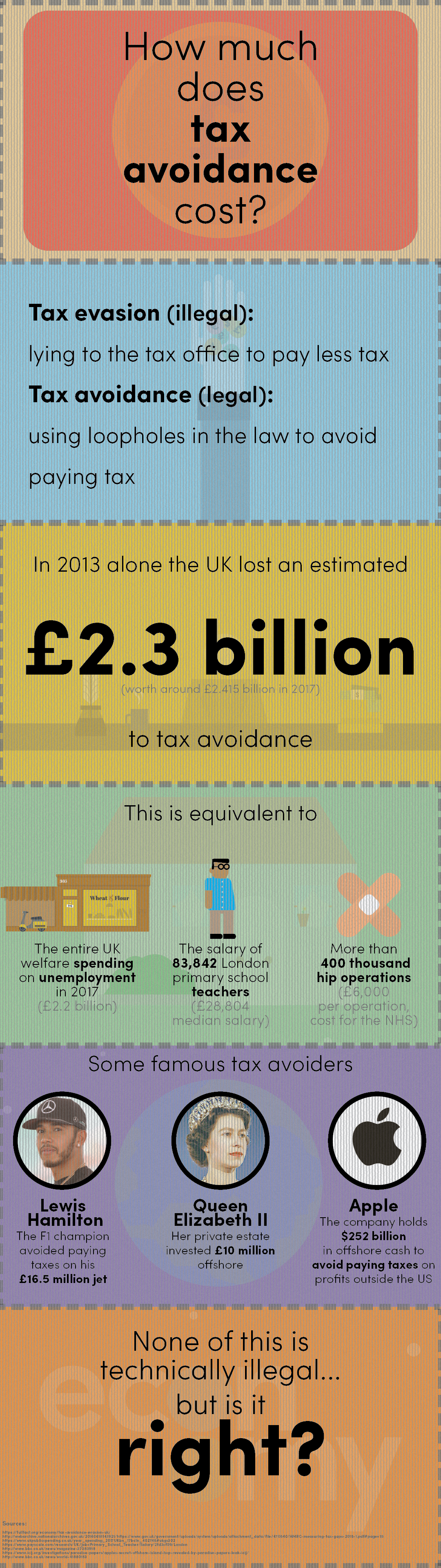

One of the ways you can avoid paying taxes legally is by opening offshore accounts.

How to avoid paying tax in uk. Five ways to (legitimately) avoid paying tax on your income and savings 1) individual savings accounts. Donating at least part of the proceeds from your cryptocurrency investment to charity will help. In the uk, your cryptocurrency donation is deductible from taxes.

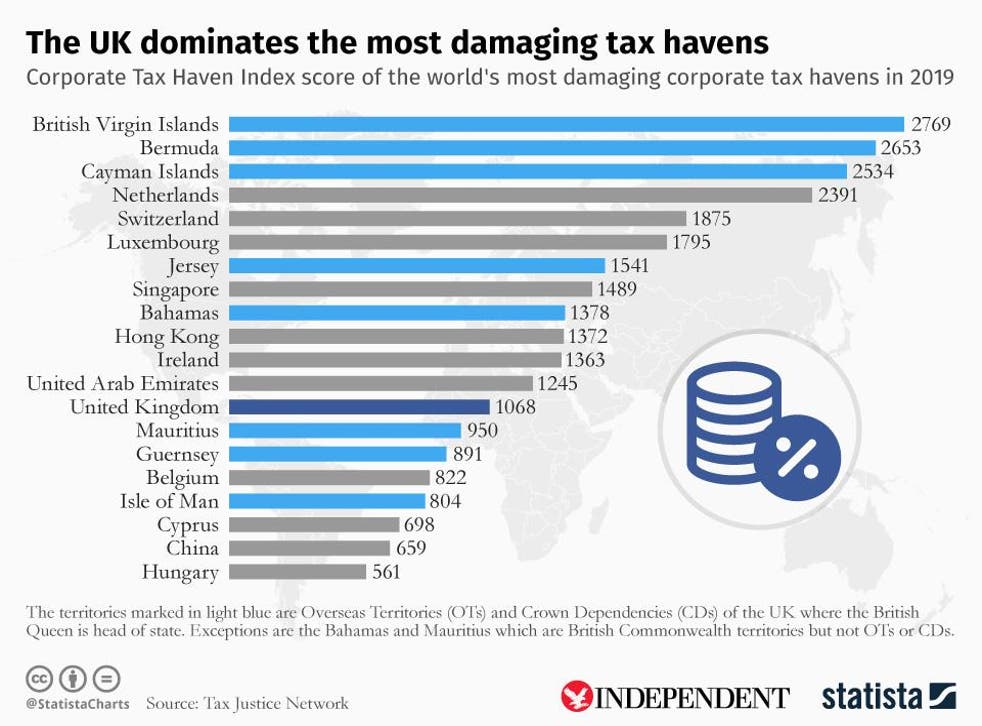

Investment property owners can avoid paying taxes on their property by using a variety of strategies. There are various ways to reduce your income, resulting in you paying less tax. Some of the tax haven countries like bermuda, switzerland, and the british virgin islands allow.

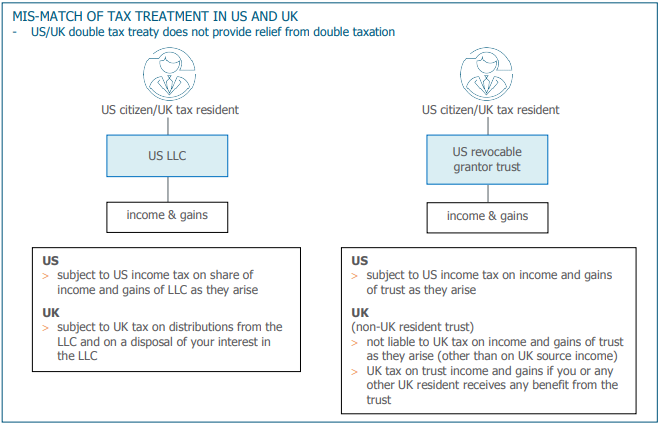

However, this is not always the case and you should always seek expert advice if you. Your status as an investor, dealer, business, charity, public body, etc. Pointers to lawful tax avoidance in the uk include:

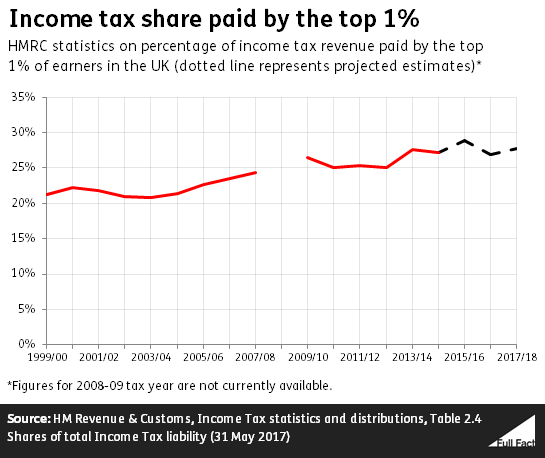

Prevent getting into council tax debts in the first place by agreeing to pay the correct amount for your property and. How the wealthy avoid paying tax. Normally, if you spend over six months of any year in a particular country, you will be classed as a resident.

Inaccuracy penalties are calculated as follows: Why pay tax at 50%, or even 40%, when by channelling all your earnings into a company you can avoid income tax altogether? Instead, limited company landlords can subtract mortgage interest costs in full from their rental income before calculating their corporation tax.

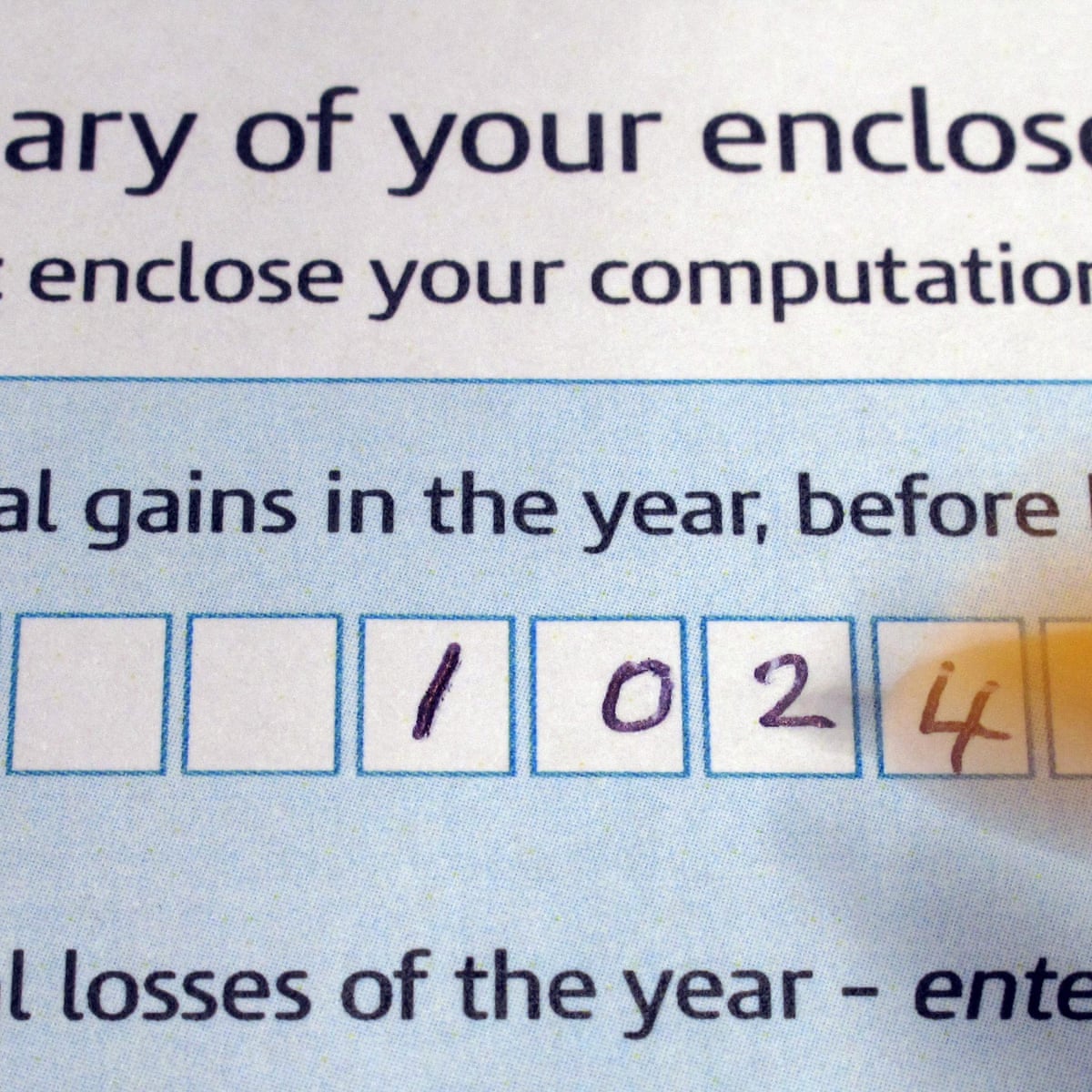

Still, the moves mean chouinard won’t have to pay the federal. The most common way is to pay into a pension, which will reduce your tax bill by the top rate of tax. Reduce your capital gains tax bill.