Glory Info About How To Develop A Financial Plan

To create a financial plan like a professional, you cannot skip this.

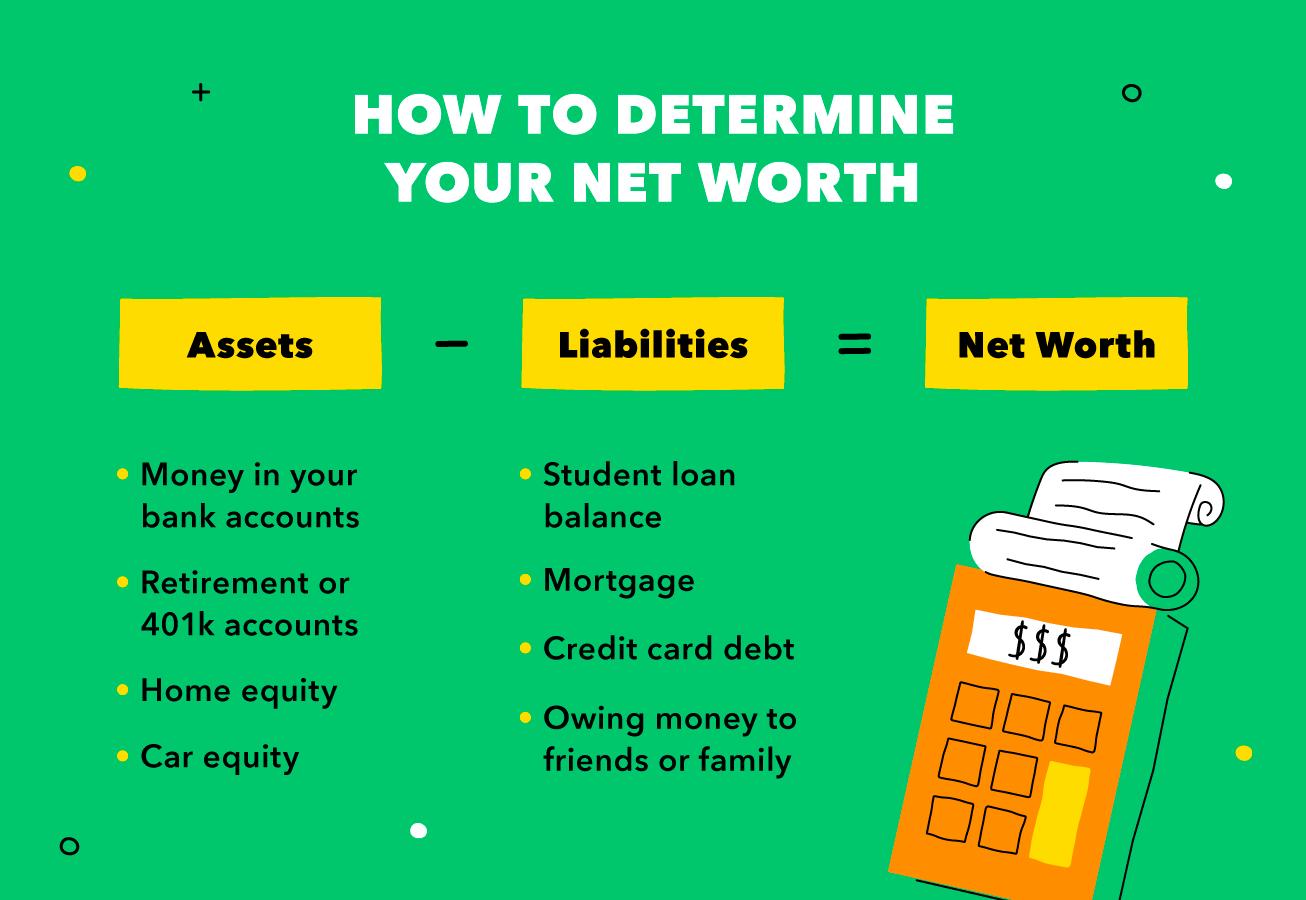

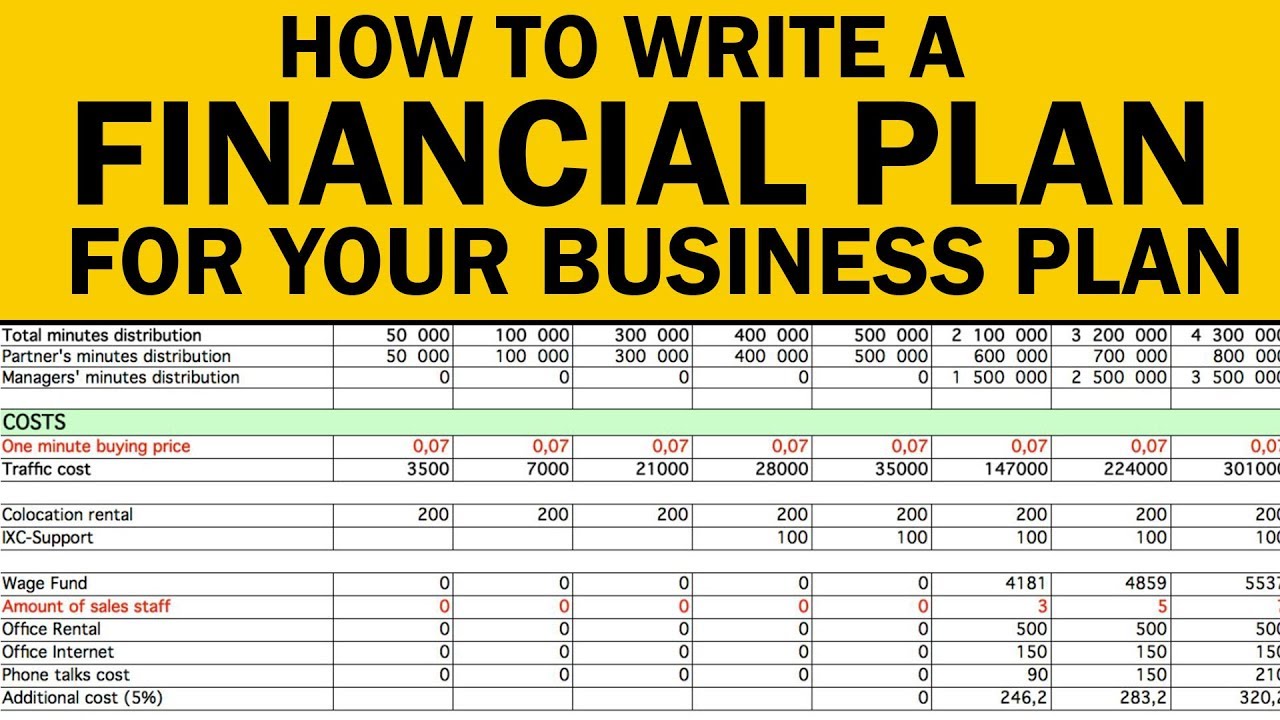

How to develop a financial plan. Think broadly about your funding needs from the start. If you already have a savings account, consider setting up automatic transfers to your savings. The key to a good budget is including as much information as possible so you can adequately prepare and plan.

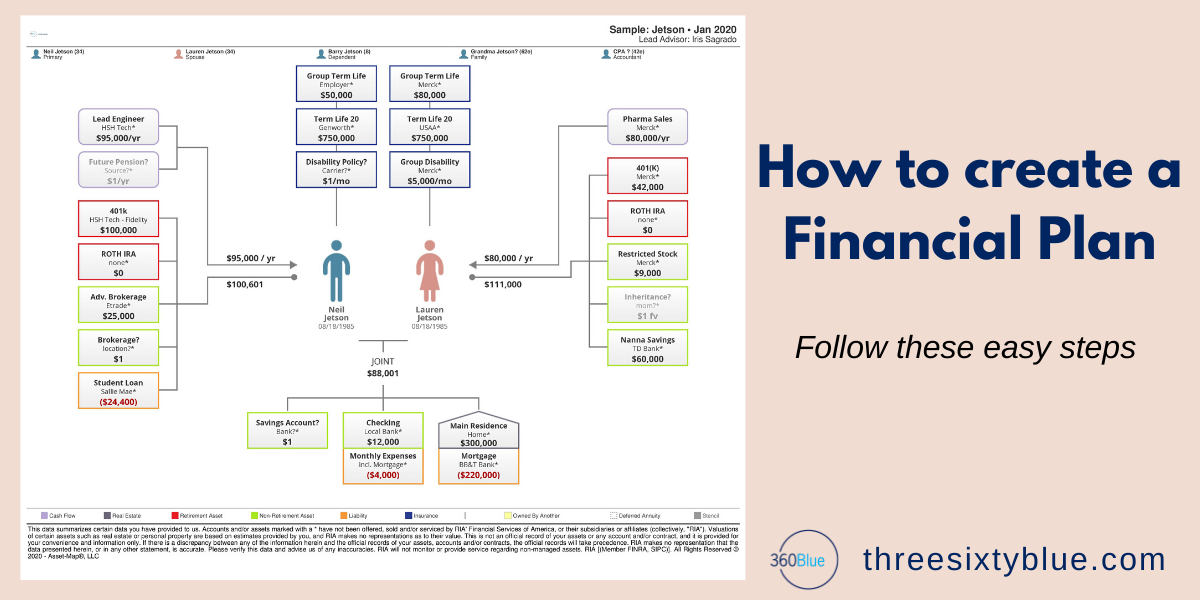

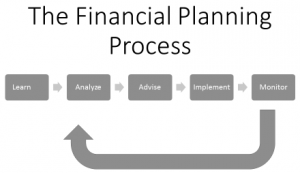

A financial plan is a roadmap for an individual or a company to reach its goals. Advisors need to create financial statements and analyze that information before creating a financial plan. Then, determine your target purchase date.

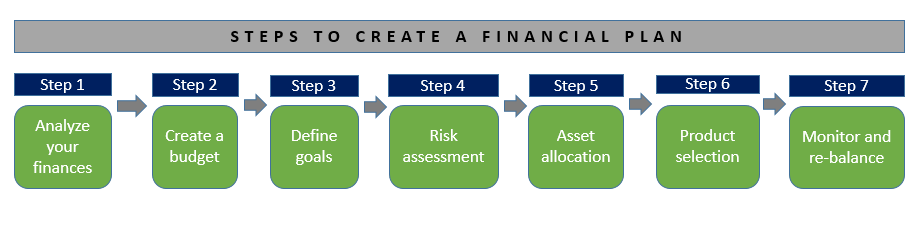

Personal financial plan has six basic steps: The process of spending that money — and when — is referred to as “decumulation.”. Once you figure out your current expenses, you’ll be able to make better future.

Open a savings account at a bank. It takes into your account your existing financial situation and goals, then creates a detailed. Look at your goals and try to assign an estimated cost to each one.

Develop your financial goals 3. Take a look at the expenses such as product equipment, utilities and other. As said before, the financial plan is a snapshot of the current state of your business.

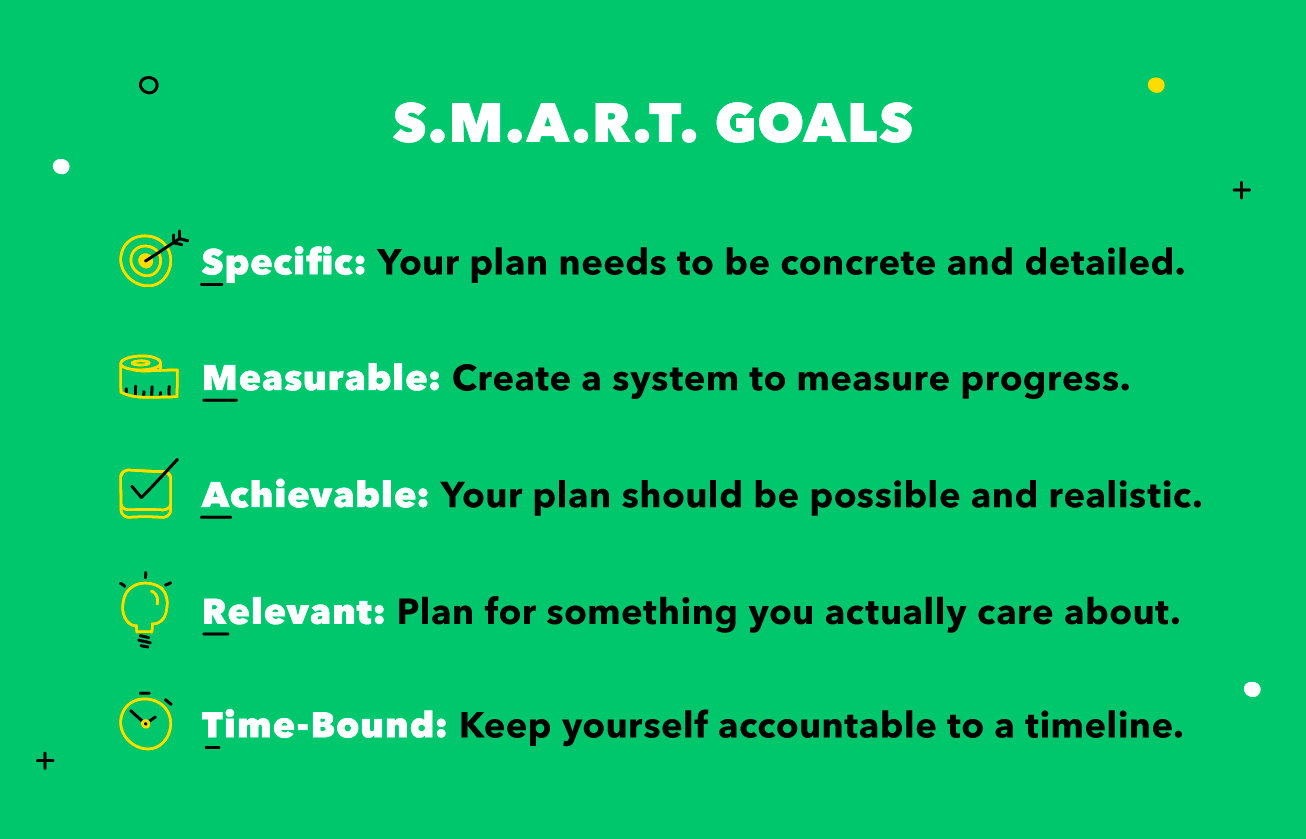

Our free & interactive quiz empowers you to make smarter financial decisions. Identify alternative courses of action 4. Your goal could be based on how much you’ll need for a down payment or perhaps to pay for the car in full with cash.