The Secret Of Info About How To Lower Credit Card Fees

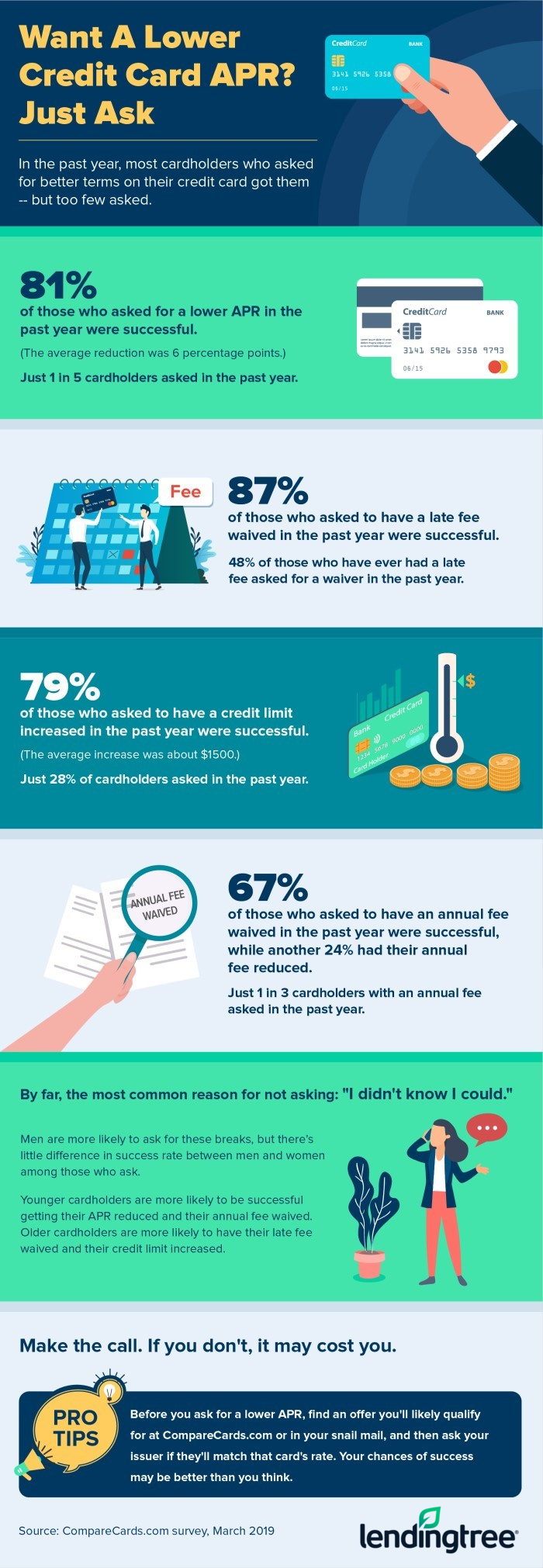

One of the easiest ways to lower your credit card payment fees is going right to the source — the payment processor.

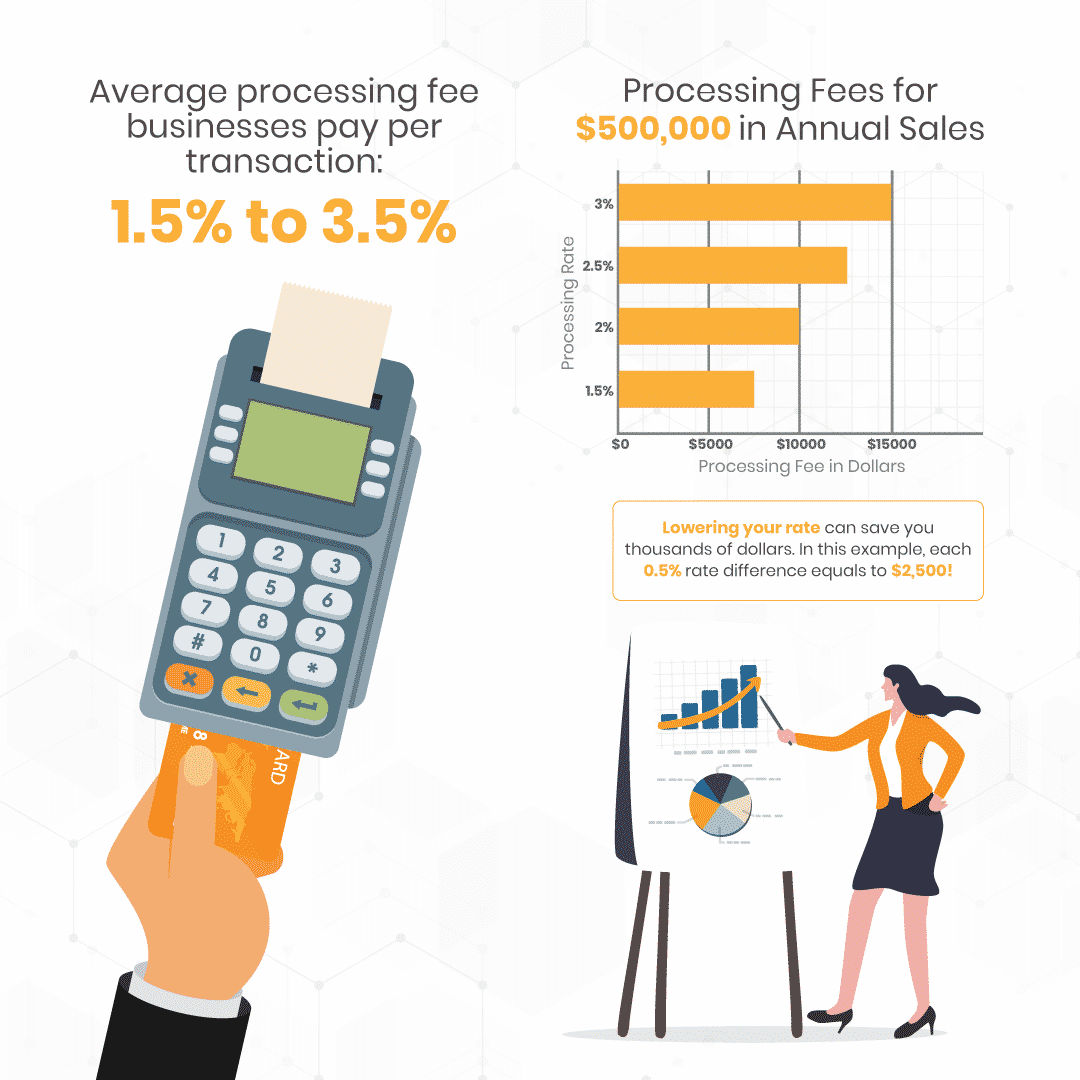

How to lower credit card fees. Average credit card processing fees range from 1.5% to 3.5%. If each transaction is worth more than $400, business processing fees are typically charged by a credit card company of 1% to 3% of the total value of the transaction. The primary apr on your credit card is the amount you will pay for new purchases after the grace period.

So, you can require more information at the time of the sale to make it less expensive to process the payment. This fee is calculated depending on the pricing. The effective rate can be calculated by dividing the total amount deducted for processing by the total.

The credit card competition act. The typical interchange rate for debit cards is just 0.5%,. Our experts selected the best cards to enjoy interest free payments until 2024.

Cnn—walmart, target, and kroger are backing two bills in congress that will lower credit card fees. If you must key in a credit card number, ideally,. The most potential for fraud is associated with keying in cards, and this results in credit card companies raising fees for this particular paying.

Learn where these fees come from and how you can reduce your cost in our comprehensive guide. Merchants paid about $138 billion in processing fees last year, according to the nilson report, a publication covering the payment industry. Understanding each of them is critical to learning how to lower credit card.

Our certified debt counselors help you achieve financial freedom. Ad we've rated the best options for getting out of debt. Use an address verification service.