Painstaking Lessons Of Tips About How To Get A Fha Mortgage Loan

As part of the u.s.

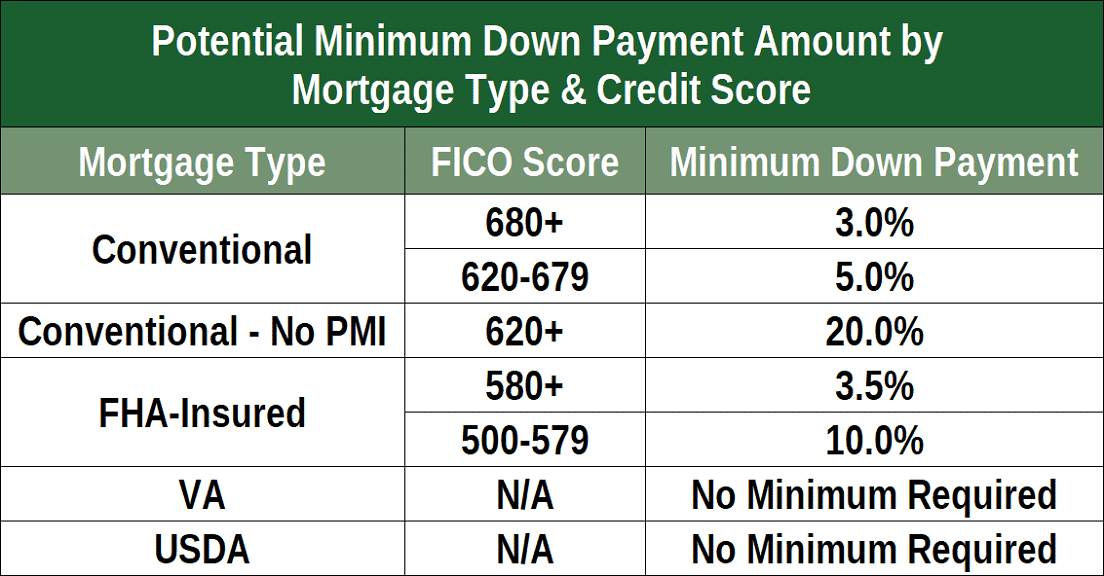

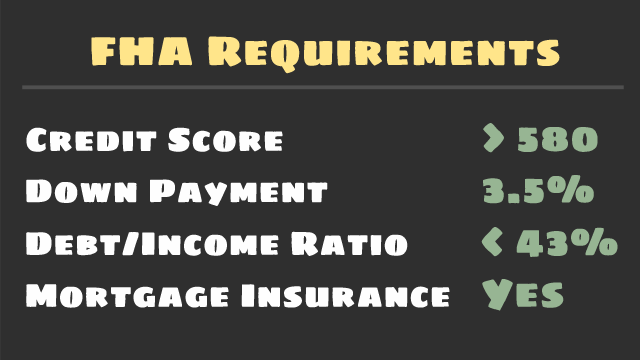

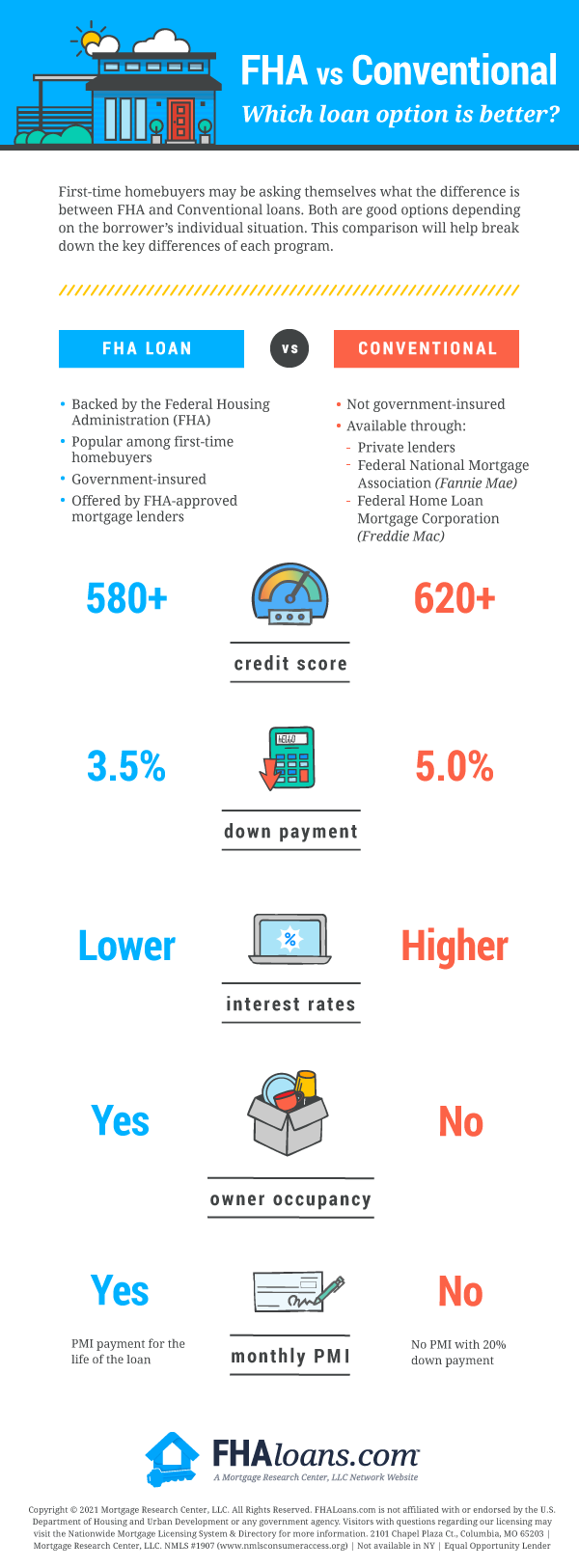

How to get a fha mortgage loan. How do you apply for an fha mortgage? Your credit score will determine whether you qualify for a loan and. Applying for an fha loan is like any other mortgage application process, meaning get ready for a lot of paperwork.

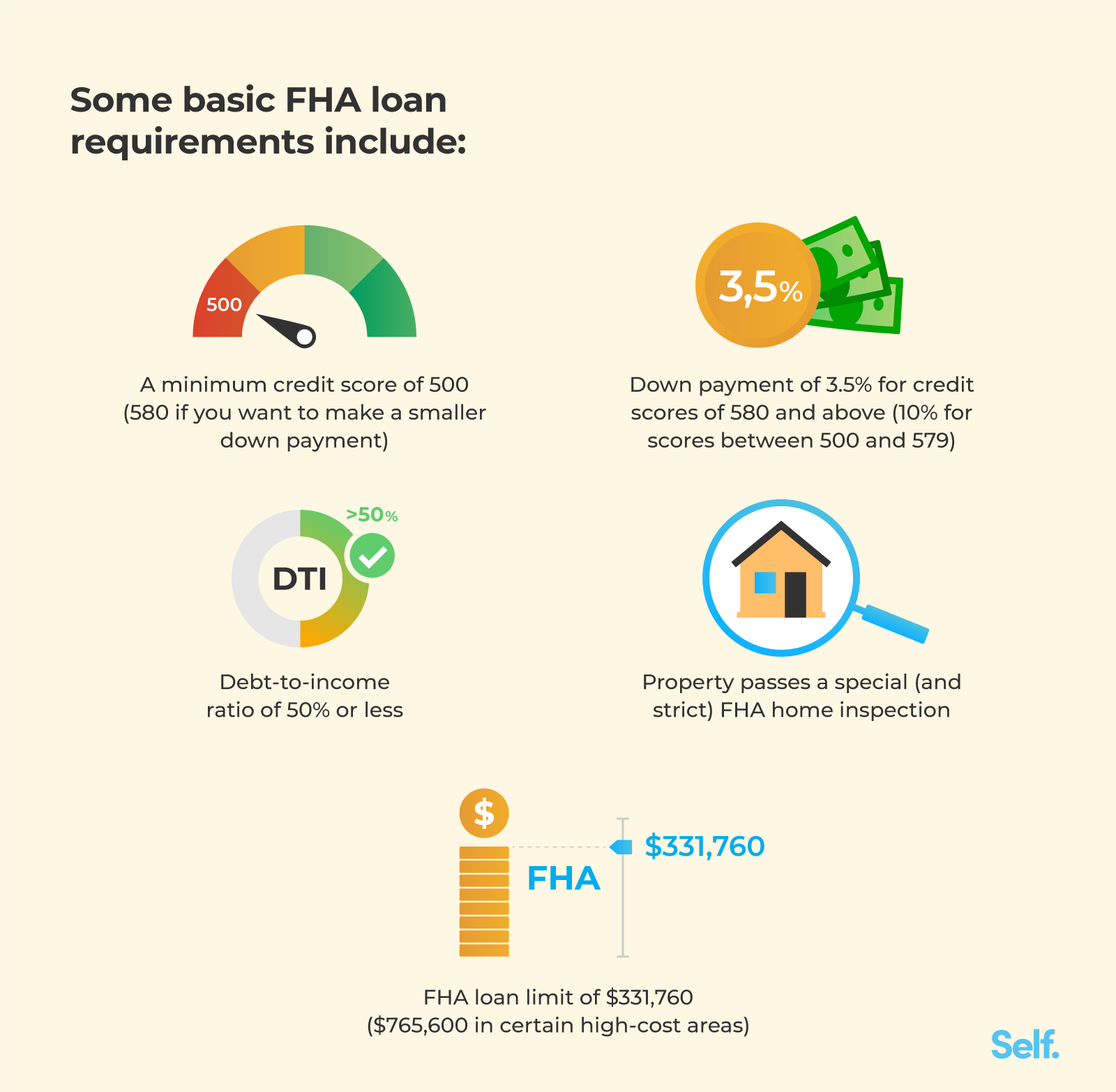

Updated fha loan requirements for 2022. Here’s how those brackets breakdown: If your origination date falls between these two markers, you can’t cancel your fha mortgage.

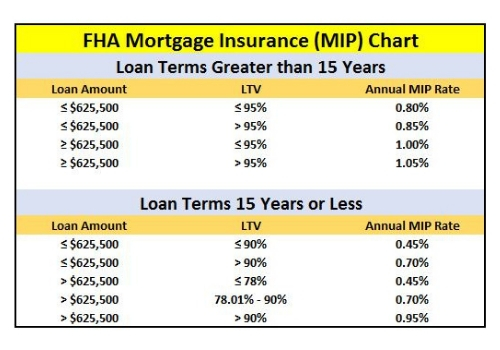

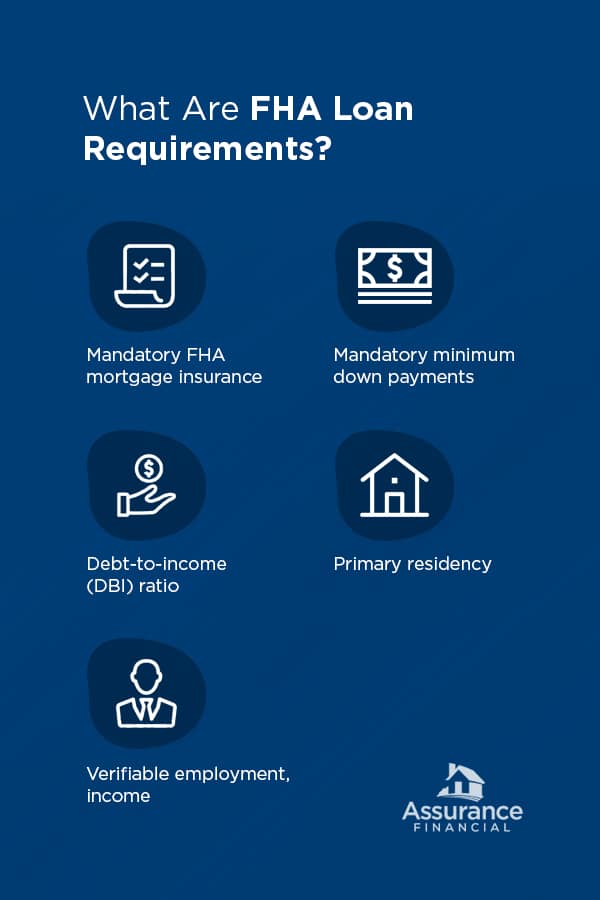

Due to the affordability of obtaining this loan, the fha has mortgage insurance built into each loan. You can also check with your lender or mortgage servicer. You apply and turn in your documentation.

You must pay this insurance in advance, which you can add to the total. You’d pay an annual mip of 0.8. You’ll need a 10% down payment and can expect the highest interest rates.

Your annual mip rate would go down to 0.8 percent for the life of the loan. Check your official eligibility today. Ad wherever you are, if you're connected to the internet, you're connected to navy federal.

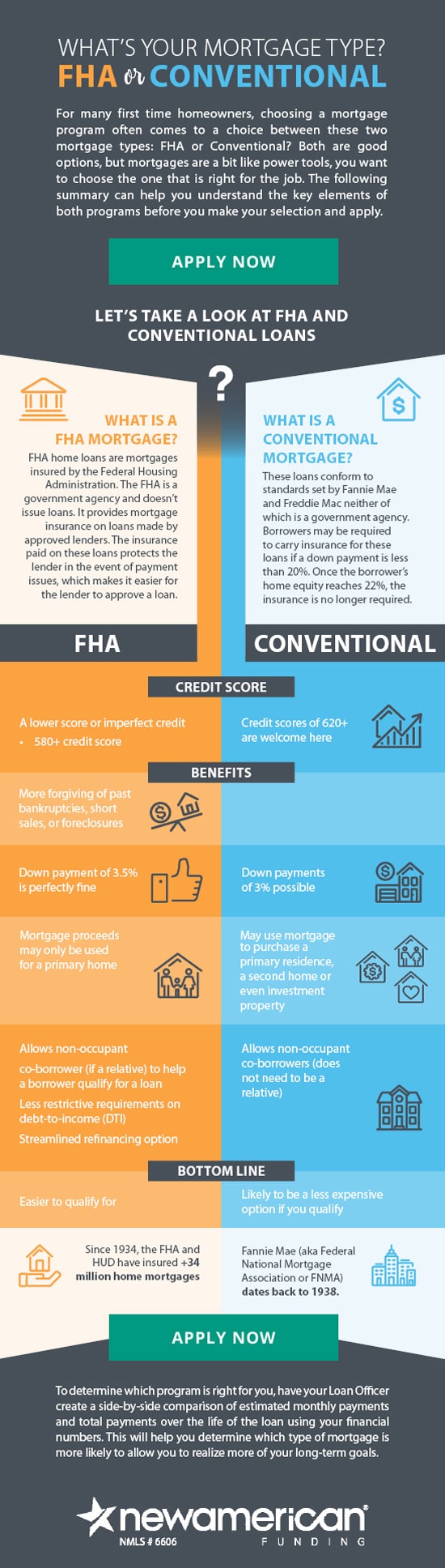

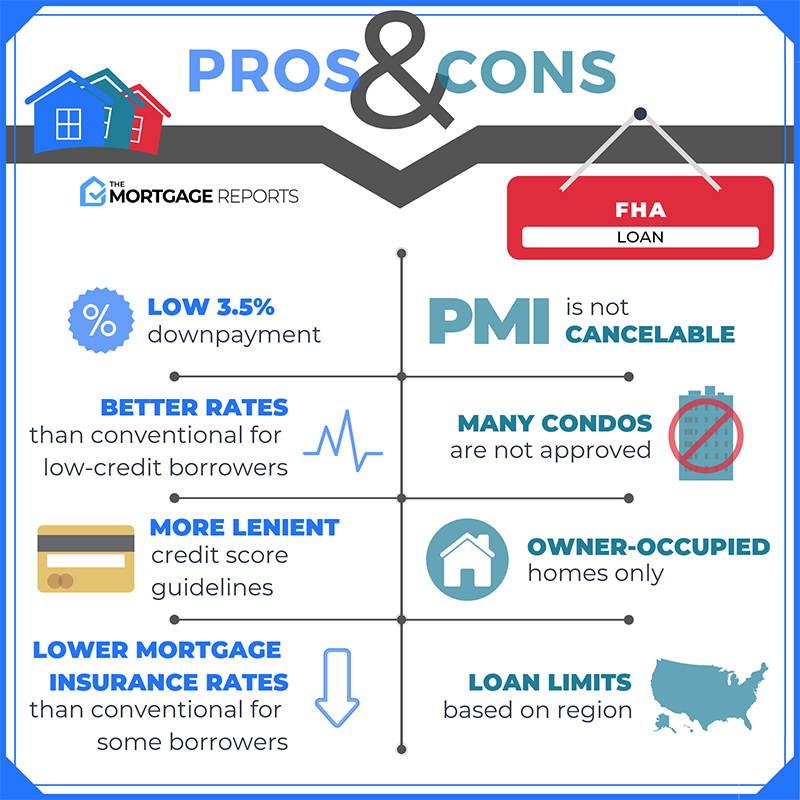

The good news is that the majority of banks and mortgage companies offer this type of mortgage,. Fha loans work by insuring lenders against default while at the same time offering borrowers with little money down an opportunity to own a home. Compare, apply & get the lowest rates!

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)